Your EdgeIn EconomicForecastingInvesting in stocks

Gain unparalleled clarity with our comprehensive data and advanced analytics, empowering smarter decisions in a rapidly changing global economy. Whether you are new or experienced, success starts with understanding the right data.

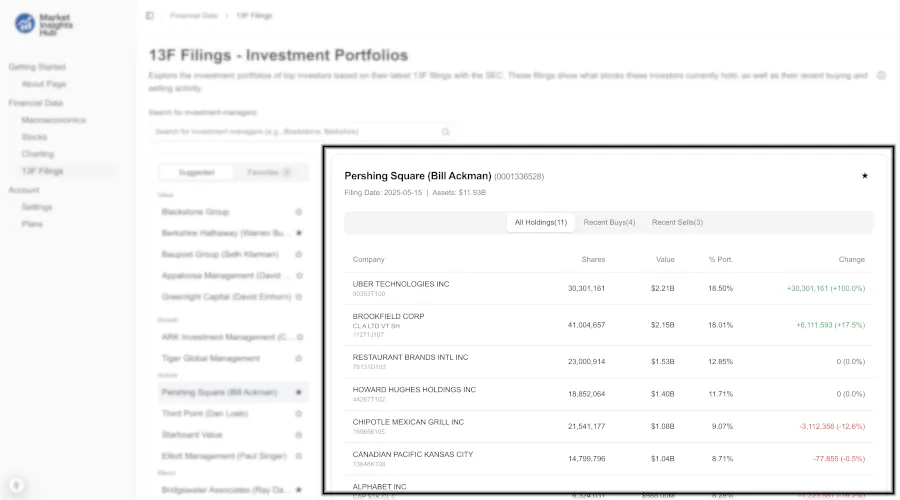

Follow the Investment Moves of Top Investors

Uncover the investment strategies of top hedge funds and institutional investors to gain a competitive edge in the market. Dive deep into their latest stock picks, portfolio changes, and market convictions through detailed analysis of their 13F filings. Discover how leading funds like Pershing Square are positioning themselves and use this valuable information to inform your own investment decisions.

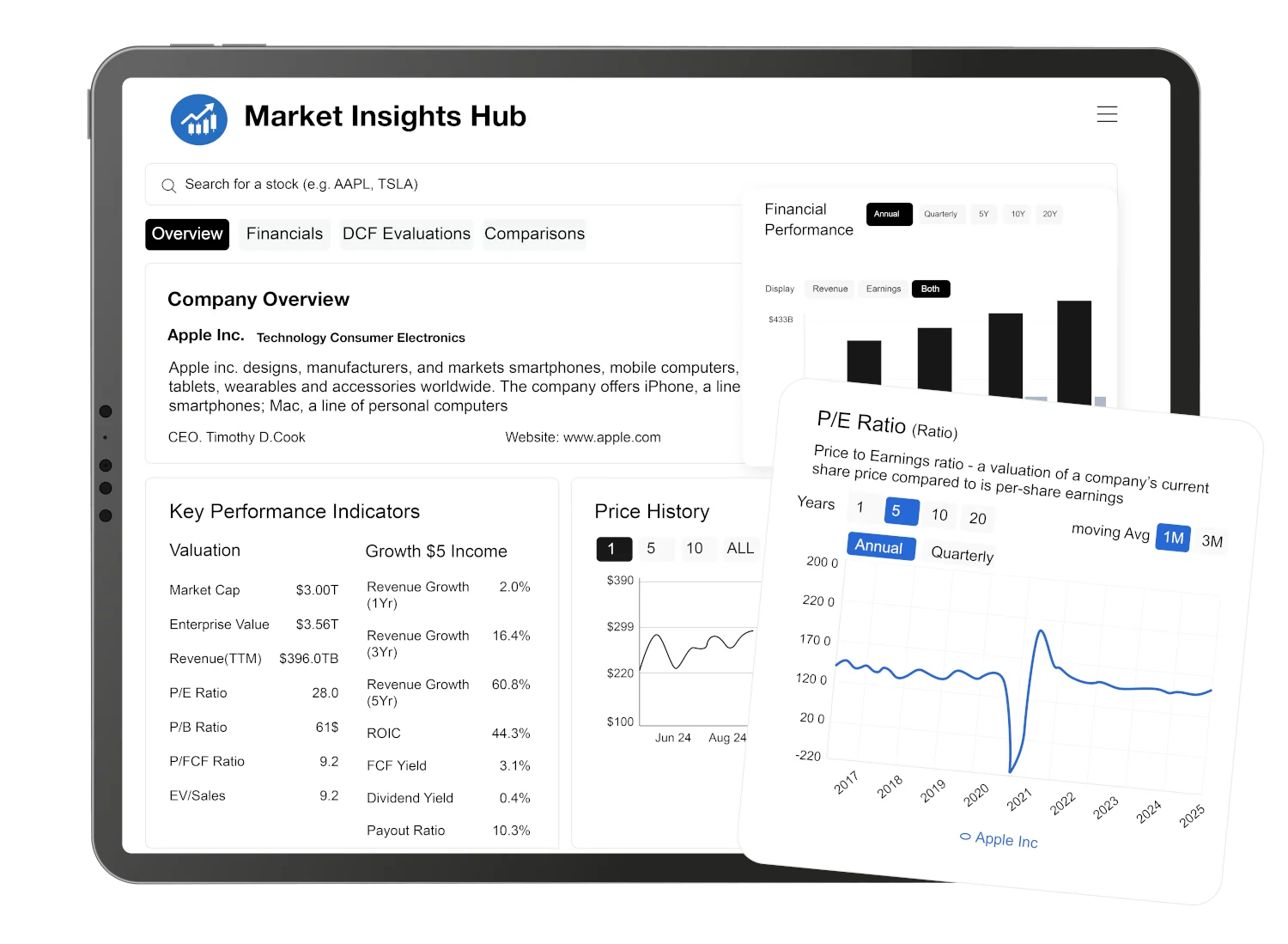

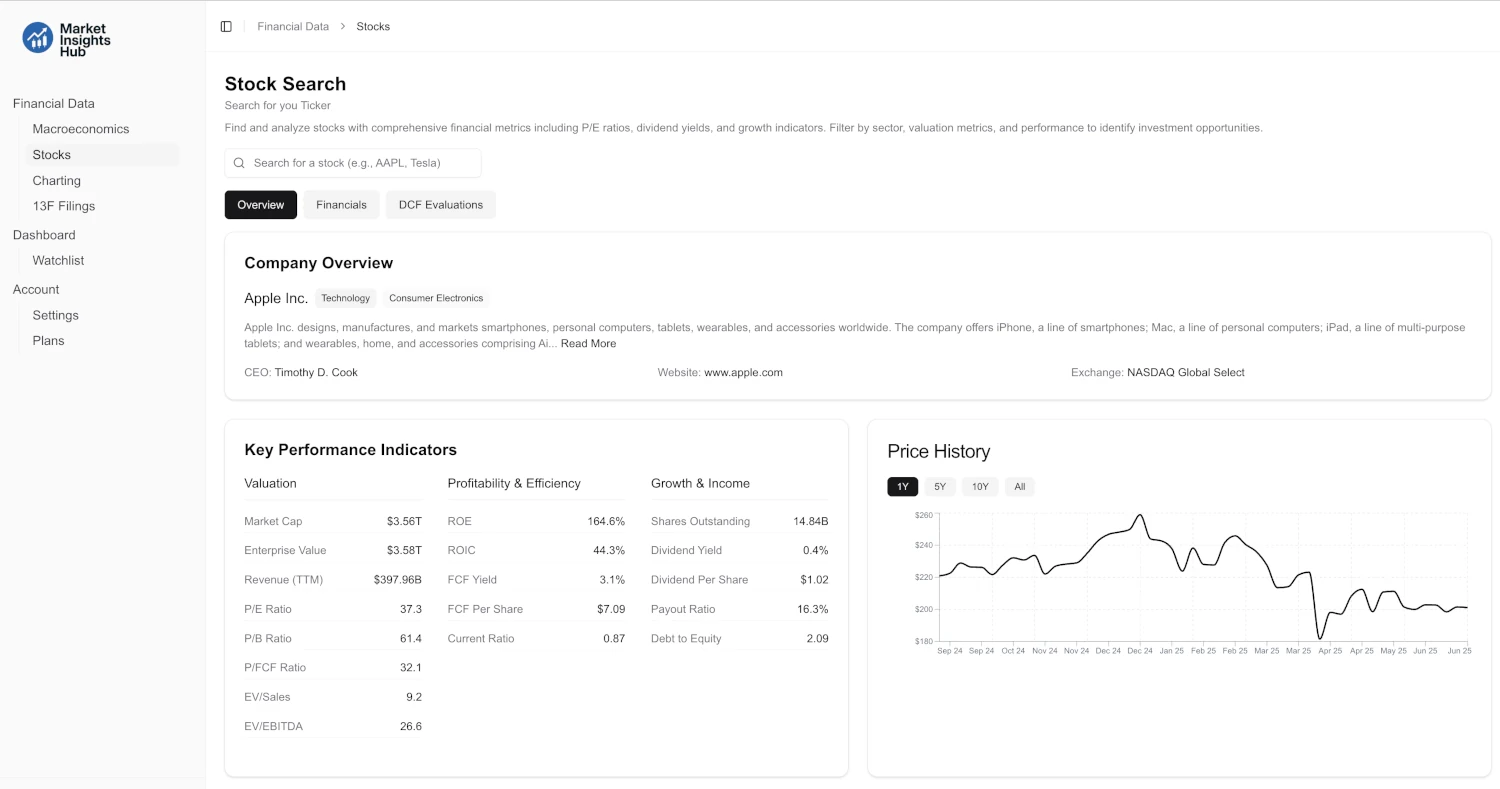

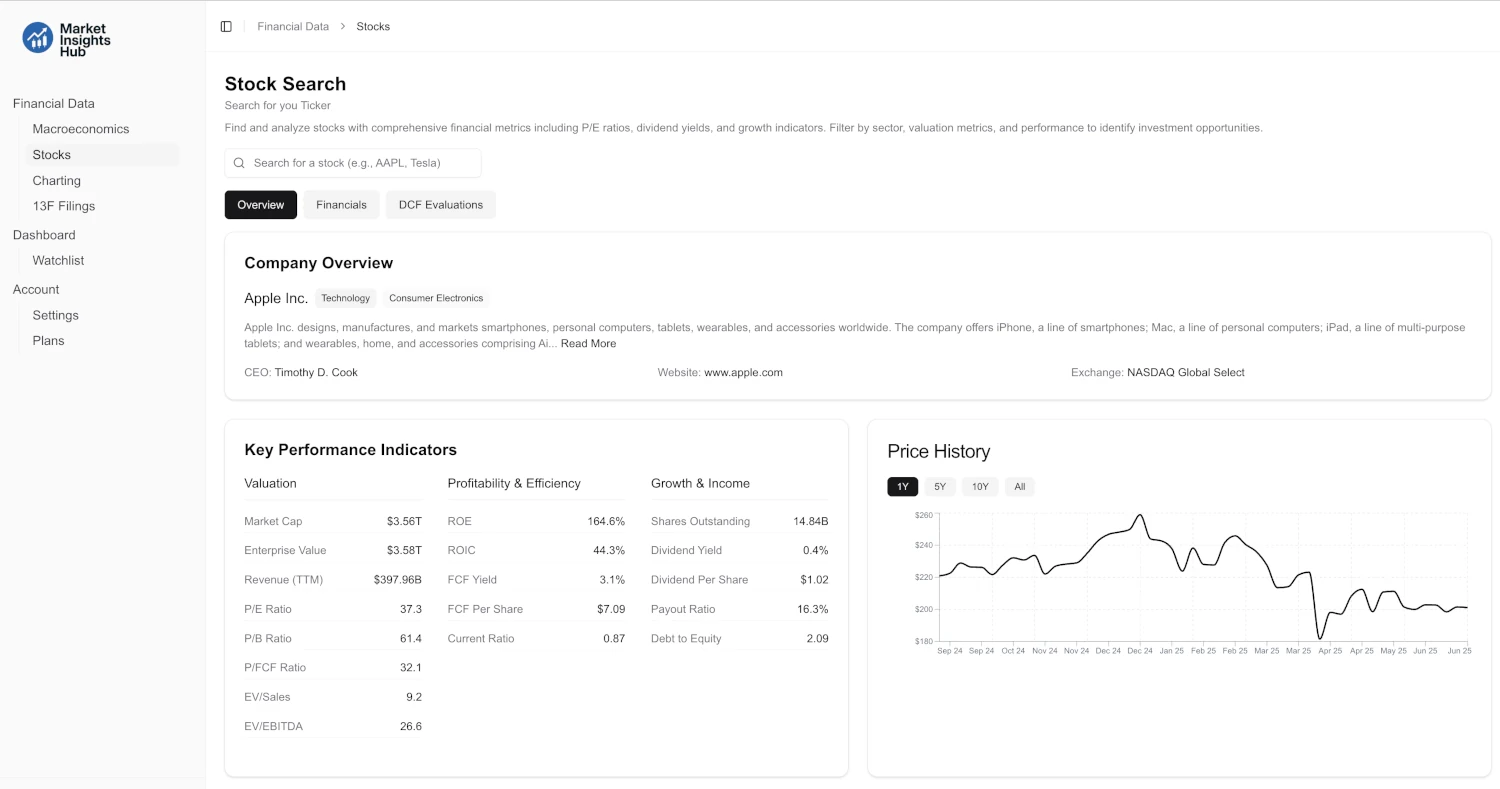

Unlock Accurate Stock Data & Metrics for Your Favorite Stocks

Access precise global financial data and metrics for public equities, ETFs, and funds with the Market Insights Hub. Trusted by leading asset managers, this modern platform provides comprehensive fundamental data and analytics to empower your investment decisions. Get started now!

Investing in stocks: Fundamental Analysis for Smarter Stock Market Research

Dive into comprehensive fundamental analysis with key performance indicators, financial statements, and price history all in one place. Explore company summaries, valuation ratios, profitability, and cash flow trends to make data-driven decisions. Start your stock market research with actionable market insights and transparent metrics.

Seamless Integration & Workflow

Gain insights into what the top institutions are holding. Our comprehensive 13F filings data allows you to track the moves of hedge funds and institutional investors, giving you an edge in your investment strategy. Efficient workflows help you stay disciplined when Investing in stocks.

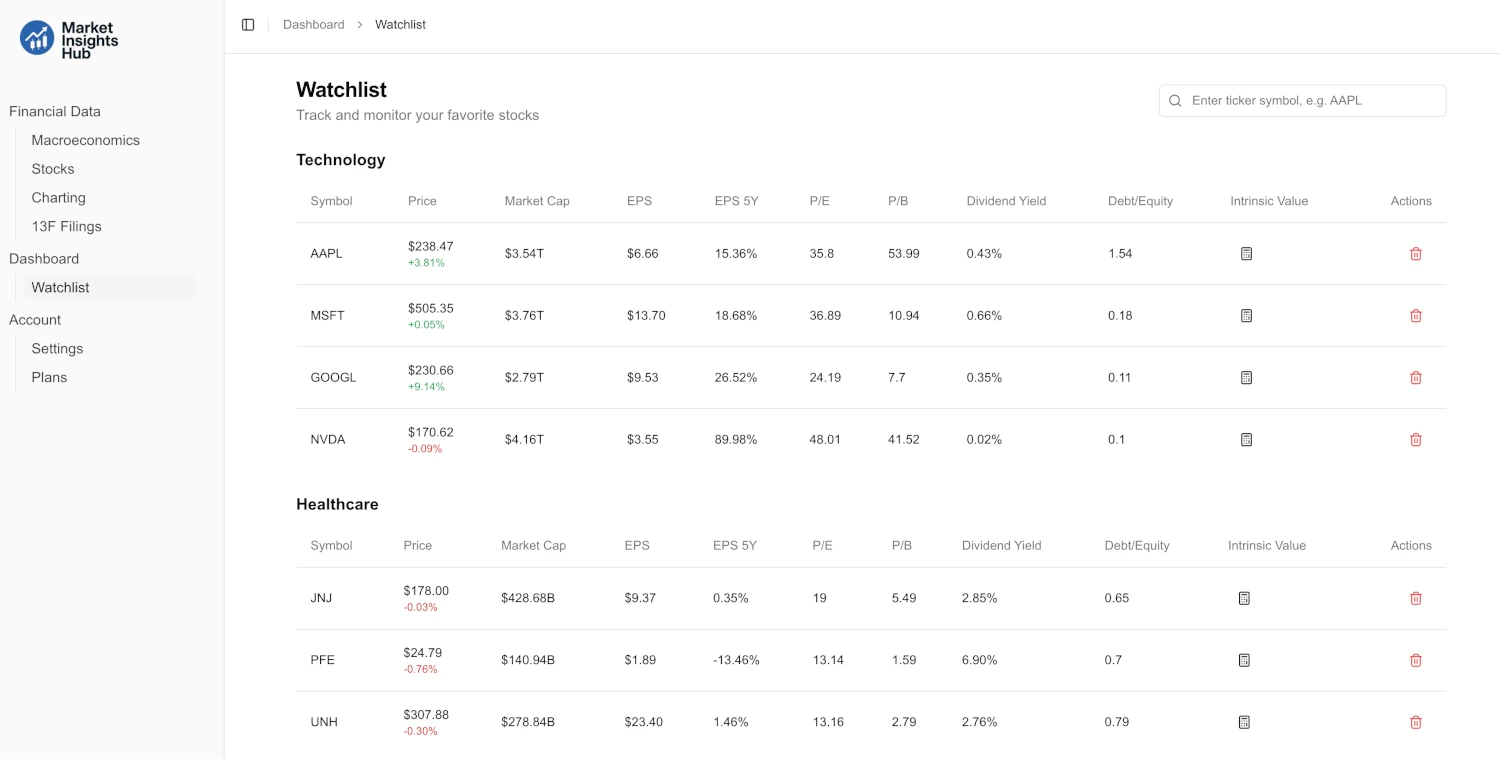

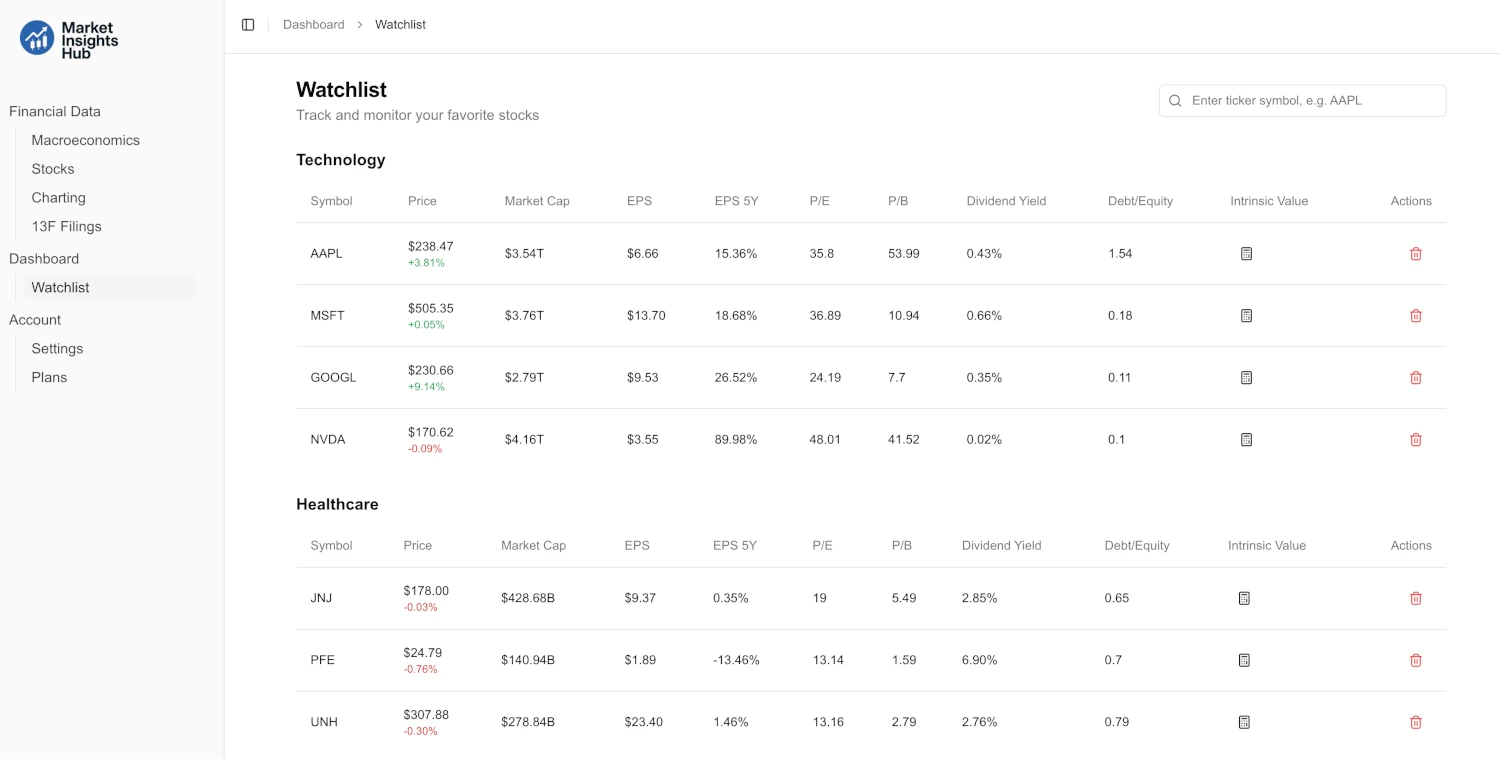

Custom Watchlists and Discounted Cash Flow (DCF) Analysis

Build custom watchlists to track your stocks and streamline your fundamental analysis. Monitor key performance indicators, set alerts, and run discounted cash flow (DCF) valuations to estimate intrinsic value. Enhance your stock market research with organized watchlists, valuation models, and actionable market insights. A repeatable process is crucial for consistency when Investing in stocks.

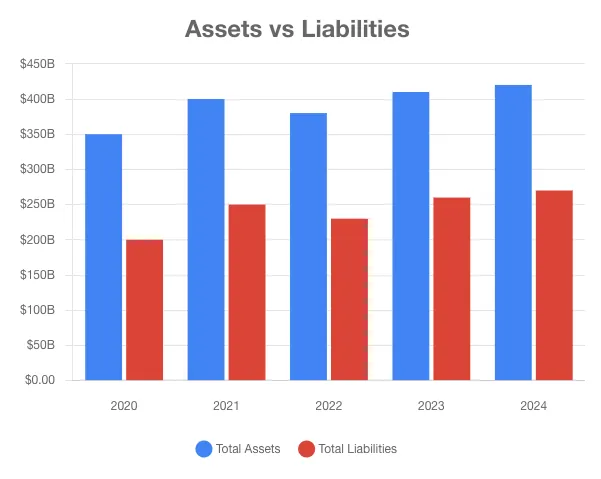

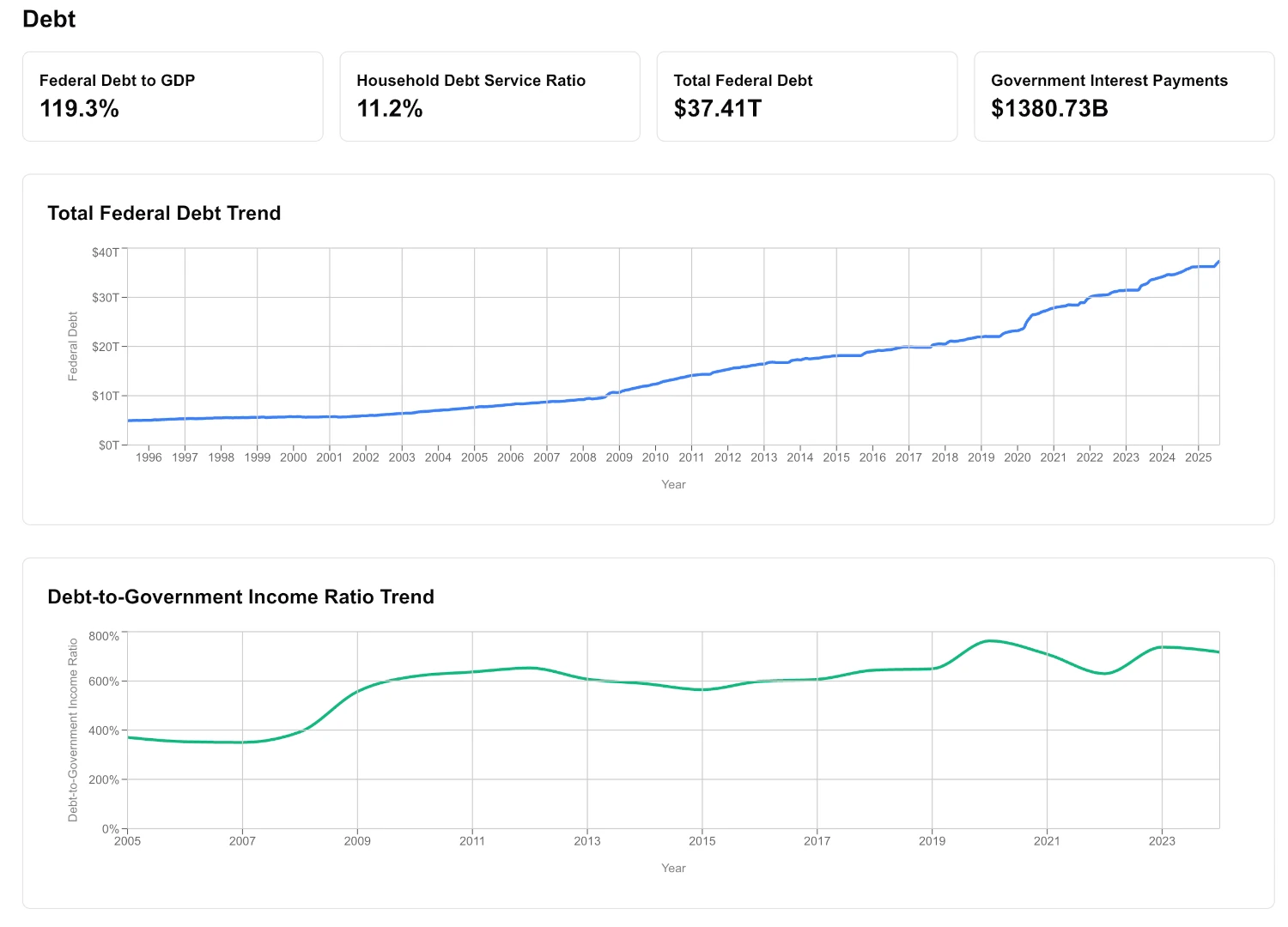

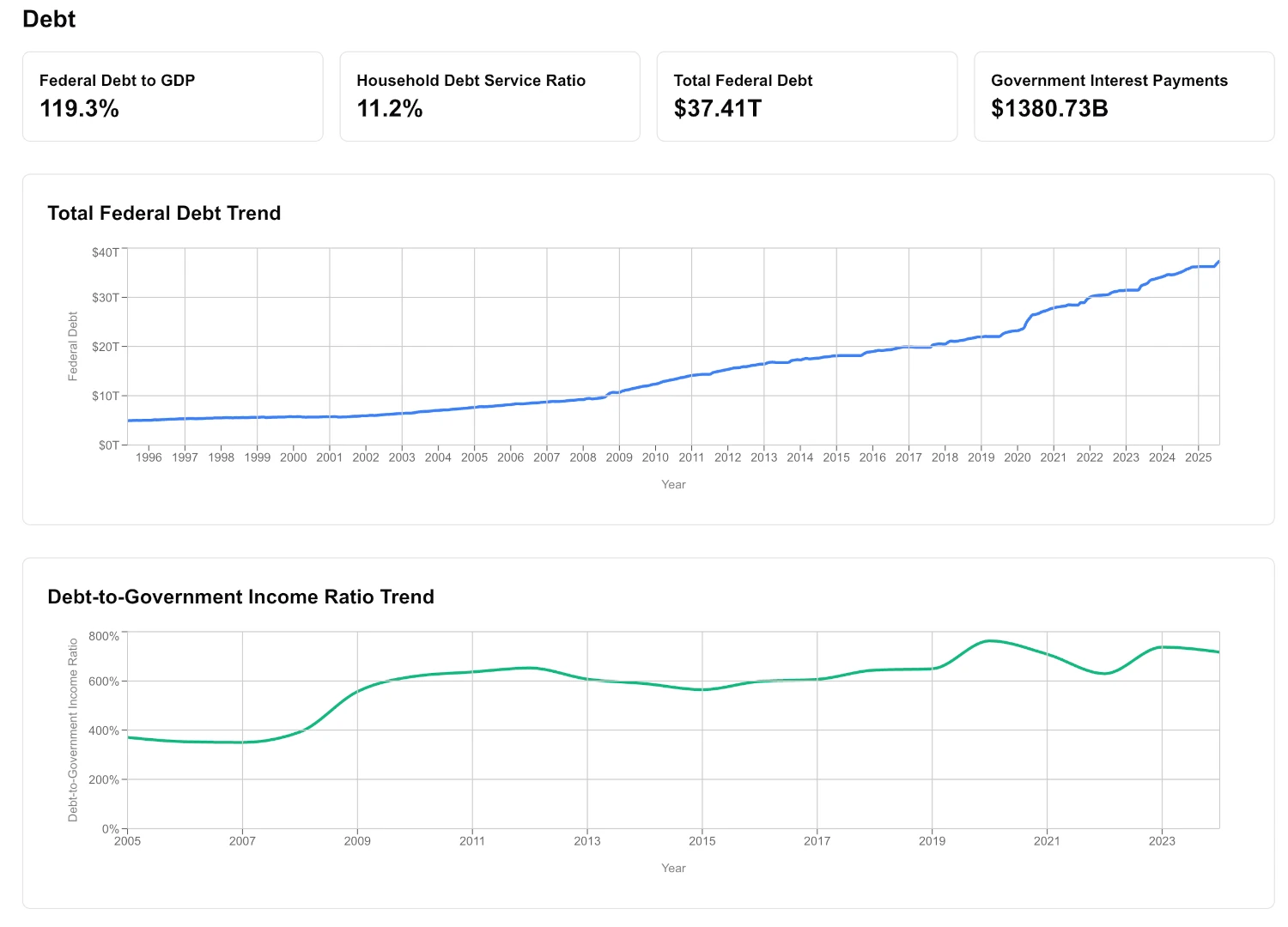

Macroeconomic Indicators Dashboard

Explore a comprehensive dashboard of macroeconomic indicators including national debt, employment trends, inflation, and government bond yields. Turn complex data into clear market insights to support your economic forecasting and fundamental analysis. Track key indicators over time and connect macro signals to your stock market research and investment strategy. Understanding the cycle can improve timing when Investing in stocks.

Unleash the Power of Global Economic Data

Access a vast repository of economic indicators, financial data, and market insights from around the globe, trusted by leading analysts and institutions for informed decision-making. Use this edge to stay consistent and confident when Investing in stocks.

Ready to Get Started?

Join thousands of users who are transforming their financial analysis.

Sign Up for Free